For units and establishments specializing in importing or wishing to import printers, it is extremely important to know the procedures for importing printers. So what specifically does this procedure consist of? Follow the article below to be revealed by Simba!

Printer source information

A printer is a type of tool or device used to create prints, or drawings of a certain type of document/image drafted or designed through the techniques and printing methods integrated into the machine.

With the increasing demand for use, in recent years, printers are one of the items that businesses and establishments promote imports. Most businesses, schools, offices, and agencies,... all need printers. That has created many favorable conditions for printer importers because the demand is increasing.

Some common and commonly used printers today can be mentioned as Laser printers; Needle printers, inkjet printers, screen printers, type printers, flexo printers, gravure printers, and offset printers,...

Printer import policy

A printer is a device that is not on the list of prohibited goods. Therefore, units and businesses can import this type of equipment to normal without having to carry out procedures such as certification of conformity or quality inspection.

Pursuant to Article 27 of Decree 60/2014/ND-CP (updated by Decree 25/2018/ND-CP effective from 01/05/2018), the list of printers required to apply for an import license includes:

- Printers using digital technology, offset, flexo, gravure, and mesh (silk) printers;

- Color copiers, printers with color copier functions.

Note: A3 paper size is 297 × 420 mm, so for printers and digital copiers larger than A3 paper size or with speeds greater than 60 sheets of A4 (210 x 297 mm) per minute, an import permit is required.

Regulations on the import of printers

Legal bases

The classification of printing papers subject to import permits is specified in Decree No. 60/2014/ND-CP and Circular No. 16/2015/TT-BTTTT (Appendix I).

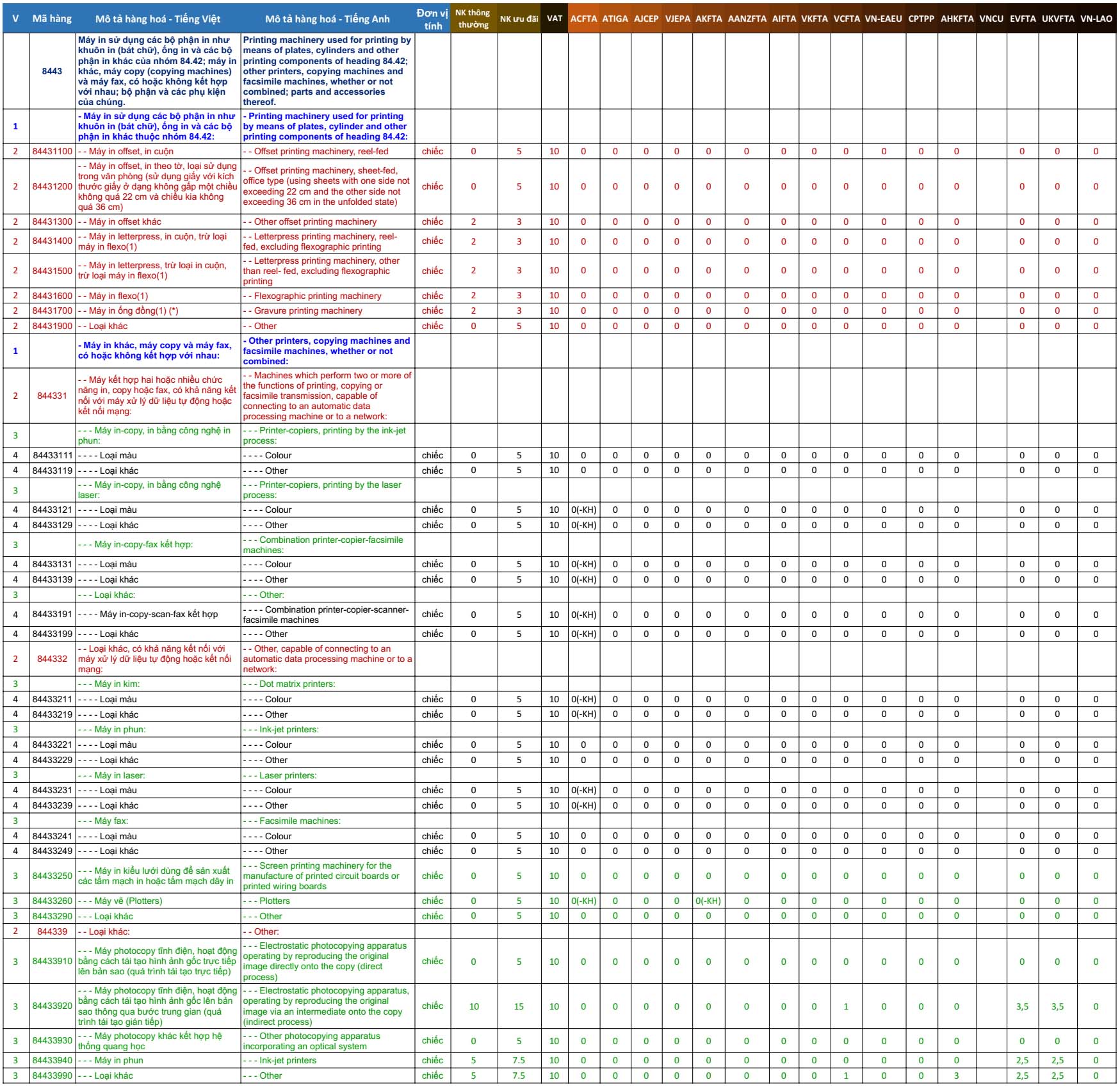

HS Code

There are many different types of printers and each type will have its own HS Code. Here are some HS Codes that Simba wants to share with importers to read:

Import tariffs

Here are the import tariffs of some popular printers today:

- Offset printer, roll printing - HS Code 84431100: Normal import duty (5%), preferential import duty (0%), VAT (10%).

- Printer-copying and printing by inkjet technology - HS Code 84433111: Normal import duty (5%), preferential import tax (0%), VAT (10%).

- Combined Printer-Copier-Fax - HS Code 84433131: Normal import duty (5%), preferential import duty (0%), VAT (10%).

- Inkjet Printer (Other) - HS Code 84433940: Normal import duty (7.5%), preferential import duty (5%), VAT (10%).

Import documents

Similar to the import of other machinery and equipment, the printer import dossier includes the following documents:

- Customs clearance documents;

- Contract of sale;

- Commercial invoice;

- Packing list;

- Bill of Lading;

- Certificate of Origin ...

Printer import procedure

Pursuant to Decree 25/2018/ND-CP, before importing printers, organizations, and individuals must make a dossier of applications for an import license. For enterprises that send dossiers through the online public service system or postal services, delivery can apply directly at the Ministry of Information and Communications. A dossier of application for a license comprises:

- An application for an import permit in the prescribed form;

- The catalog of each type of printing device;

- Certified copies of certain documents are regulated.

After about 5 working days, the Ministry of Information and Communications will issue import licenses for eligible printing devices. In case the equipment is not eligible for import, the Ministry of Information and Communications will issue a written statement clearly stating the reason for sending it.

After being granted an import license, enterprises proceed with customs procedures to obtain customs clearance of goods.

Answer some other questions about printer import procedures

Do old printers need an import license?

All types of printers on the list of licenses must apply for an import license. Specifically about the question "Do old printers need an import license?" the answer is no. However, when clearing customs with this equipment, it needs to be inspected by inspection agencies. And in addition, old printers need to meet the requirement for no more than 10 years.

Do thermal, embossed, and 3D printers need to apply for an import license?

Because thermal, embossed, and 3D printers are not on the list of printers that must apply for an import license according to Circular 22/2018/TT-BTTTT, when clearing customs, enterprises do not need to apply for an import license.

Above is some information about printer import procedures that Simba wants to send to the trader. Hopefully, through the sharing of import procedures in the article, it will bring individuals and importers a lot of useful information. And in addition, if the trader is in need of importing Chinese goods or has any questions about import procedures, please contact us via Hotline at 037.931.1688 for detailed advice!