Currently, ceramic tiles have been commonly used for large projects as well as modern houses. So are you curious what the specific procedure for importing ceramic tiles includes? Let's find out with SIMBA GROUP through the article below!

Information about ceramic tile products

Ceramic tiles are a type of sheet material and are derived from natural or artificial. This is a popular building material used for wall cladding, flooring or decoration for the purpose of increasing the aesthetics of construction works and houses. You can learn more about the concept of ceramic tiles in Section 1.2 QCVN 16:2017/BXD.

The types of ceramic tiles that can currently be marketed bring specific effects and benefits as follows:

- Increase the aesthetic value of walls, floors.

- Create a flat, smooth surface for easy cleaning.

- Increase waterproofing of house structures.

Conditions for importing ceramic tiles

Based on Circular 19/2019/TT-BXD, units and enterprises importing construction materials are required to certify construction materials regulation conformity. This will be similar to when importing ceramic tiles to Vietnam. After carrying out the procedures for certification of conformity, ceramic tile products will be allowed to be sold in the market.

According to the regulations on procedures for importing ceramic tiles, when making a certificate of conformity for goods, you will need to prepare a set of documents including:

- Application for registration of product regulation conformity certificate.

- Bill of Lading.

- Commercial invoice (Invoice).

- Bill of Lading (Packing List).

- Contract of sale.

- Customs declaration.

- Product samples for test registration.

When imported ceramic tiles arrive at the port, enterprises will have to prepare a regulation conformity paper and a letter to bring the goods to the storage warehouse, combined with taking test samples. The time to return the results will be about 3 days and the business will do customs clearance for the shipment.

Procedures for importing ceramic tiles

HS code

Ceramic tile products imported to Vietnam will have HS codes under Chapter 68 and Chapter 69 specified as follows:

- 68114021 – HS code of floor tiles or wall cladding containing plastic components.

- 68114022 – HS code of bricks used for roofing, surface cladding and partitions in construction works.

- 68118210 – HS code of floor tiles or wall cladding containing plastic.

- 68129920 – HS code of tiles used in wall cladding or flooring.

- 69072313 – HS code of glazed paving cranes.

- 69072391 – HS code of floor tiles or paving, unglazed.

- 69072393 – HS code of floor tiles or furnace beds, glazed wall cladding.

Besides, you also need to save the air of semi-dry pressed tiles and flexible extrusion tiles with HS code as:

- Semi-dry pressed ceramic tiles: 6907.90.10 (for unglazed products); 6908.90.11 (for glazed products).

- Flexible extrusion ceramic tiles: 6907.90.10 (for unglazed products); 6908.90.11 (for glazed products).

Import tariffs

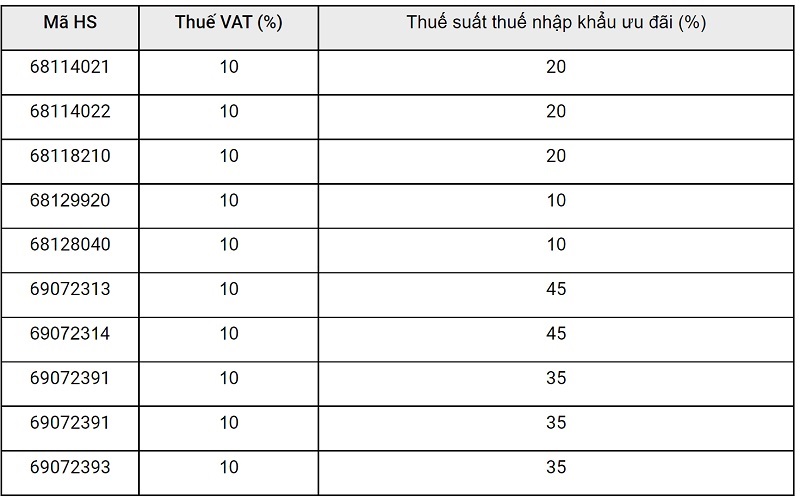

Currently, the market is distributing many different types of ceramic tiles, and each type of ceramic tile when imported will have a different HS code. Below you can refer to the tariff of commonly imported ceramic tiles!

Import documents

When importing ceramic tiles to Vietnam, the dossier you need to prepare will include the following:

- Contract of sale between two parties: 1 copy.

- Commercial invoice (Invoice): 1 copy.

- Packing List: 1 copy.

- Bill of Lading: 1 copy.

- Introduction: 2 copies.

- Certificate of Conformity: 1 copy.

- Certificate of origin (C/O). 1 copy.

Import Contact

Above is the information about the procedure for importing ceramic tiles that SIMBA would like to introduce to you. Hopefully, this article will provide you with useful information about import procedures.

If you are having questions about import and export procedures as well as are in need of sourcing quality goods for business. Please contact SIMBA GROUP immediately via fanpage or hotline: 037.931.1688 for direct advice